I wrote a couple days ago about averaging into the markets while they are declining vs keeping cash on the sidelines and used World War 2 as an example. I also hinted that there was another interesting fact I found out during that period wen I was reviewing the S&P 500.

The interesting fact was this - the war was officially declared done in September 1945. According to Wikipedia Japan announced surrender on August 15, 1945 and then officially signed the surrender document on September 2, 1945 - thus ending the war.

There were a series of different battles and different countries announcing defeat in the years prior to that - but the war officially ended on that day.

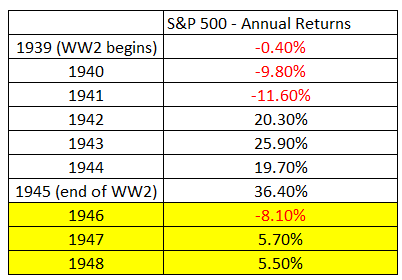

While the news was good - the subsequent returns for a few years weren’t as strong as they had been throughout the back half of World War 2:

Source: Dimensional Fund Advisors Matrix Book

A friend and fellow advisor Carlo Valle (who was also in the military and is a history enthusiast) told me this:

"“1945-46 was some of the hardest years in terms of ecnomics. Once Germany and Japan surrendered, now the allies had to feed those people as well, making rationing even harder.”

From 1949 and on kicked off the post WW2 economic boom with some incredible returns but the point I want to make is specifically this:

If you had to ask yourself when the best time to invest during WW2 was. Would you have guessed right in the middle of the war? Or would you have guessed the end?

I’m betting most people would have bet the end. The reason is - we all want to “invest when things get better”. Even now - many of the questions I’m getting are around “should we wait until things get better to invest?”.

While no one can predict the future - generally - markets come to conclusion that things are getting better before you or I do.

It reminds me of this chart:

The point Dimensional makes here (and many other companies have as well) is that the stock market had most of it’s declines before the recession was officially announced. Subsequently - a large chunk of the gains were had before the recession had ended.

This is why people say “economic data is backwards looking and the stock market is forward looking”.

I know some readers will look at this chart and say “so the best time to invest is right after the recession is called - so I should wait for something like that”. That is a market timing decision that most people will get wrong. I promised to keep these short and sweet so I’ll take that idea of “what if I tried to get out before most of the crash and get back in after the recession was called” another time.

The key takeaways I wanted to make are:

In a lot of these cases - the bottom of the market coincides with when things suck the most. So trying to “wait for when things are better” often plays into the trap that everyone else falls into.

Instead - keeping those recurring contributions going, and reminding ourselves that no one really knows the future allows us to look at moments like this and say “we are better off sticking to the plan”.

See you tomorrow.

Aravind Sithamparapillai is an Investment Advisor with Aligned Capital Partners Inc. (“ACPI”). The opinions expressed are those of the author and not necessarily those of ACPI. This material is provided for general information and the opinions expressed and information provided herein are subject to change without notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on the information presented, please seek professional financial advice based on your personal circumstances. ACPI is a full-service investment dealer and a member of the Canadian Investor Protection Fund (“CIPF”) and the Canadian Investment Regulatory Organization (“CIRO”). Investment services are provided through ACPI or Ironwood Securities of Aligned Capital Partners Inc, an approved trade name of ACPI. Only investment-related products and services are offered through ACPI/ Ironwood Securities of Aligned Capital Partners Inc. and covered by the CIPF. Financial planning and insurance services are provided through Ironwood Wealth Management Group. Ironwood Wealth Management Group is an independent company separate and distinct from ACPI/ Ironwood Securities of Aligned Capital Partners Inc.