Should I keep investing while markets are falling?

If I have a recurring contribution on - does it make sense to keep it going or stack up cash on the sidelines instead?

Many people deep down know that they “should” stay invested and with an account like an RRSP where you know you have to pay the tax to pull it out - it’s easier to shrug and let it ride.

What about money we haven’t put in yet? It can be really scary to continue to invest while the news is scary and while things are uncertain. A VERY common question to ask is “should I just wait until things get better to invest?”

Before getting into the math - let’s clarify something.

Prices get lower when things seem bad. You wouldn’t pay full price for a burning building after all. You would want a huge discount…especially if it’s burning and you don’t know what will be left.

That’s what happens during moments of uncertainty. When it feels like things are burning down is when prices go down. When things feel good - prices are already on their way up.

So - continuing to invest during a period of market chaos like this (assuming you have the right portfolio that’s tailored to your risk tolerance, and is well diversified and all) is usually the right call…but it legitimately feels like you are choosing to set your money on fire.

It’s not easy to do…yet it works out.

Here’s an example:

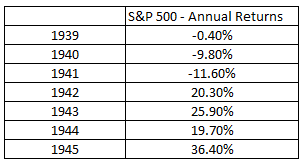

The S&P 500 from 1939 to 1945 returned an average annual return of 10.1%. (Source: Dimensional Fund Advisor’s Matrix Book).

What’s interesting about that is the annual returns. They start off negative and finish strongly positive. Yet another reminder about good periods of returns often following bad periods.

World war 2 kicked off in 1939 and consequently made things very uncertain for a few years and yet - you still came out the other end alright. Starting 1939 off you could have invested $1,000 , watched it fall 20% over the next 3 years…only to rebound to double your initial investment in 7 years. (I originally put $100K and then my wife asked me if that was a realistic number for back then…she was right 100K would have been the current day equivalent of $2 million. My wife for the win.).

The question now though is “is it better to invest if I know things are getting bad or should I wait until it get’s better?”. To test this theory I decided to compare 2 scenarios.

Scenario 1: Dollar Cost Average (DCA) right away: We start with our $1K invested and then we add an extra $250 at the beginning of each year for the next 4 years (just like a recurring contribution). This tests the idea of continuing to invest even while the markets (and likely the news) are getting worse.

Scenario 2: “Wait till it get’s better” We start with 1K, and we add $250 in 1939 but after the markets finish negative we say “I will wait until things get better” (much like everyone is asking now) and therefore we don’t start investing until 1943 after we see a year of positive returns. So then we invest $250 per year from 1943 to 1945.

Years where an extra $250 at the beginning of the year was invested are highlighted in yellow. The winner is bolded. (The original scenario of $1000 didn’t have the extra $250 a year included at all.)

This feels crazy - that continually investing into a falling market is better off that waiting for the tide to turn and then put your money in. The math and the reality says though - that you need to be able to invest into lower prices and the only way you actually get to do that is buy as markets are going down. Think of it like stocking up on something on sale and hoping you can buy enough before they jack the price up.

Getting more money in through the bottom meant we had more $$ riding all the strong returns up.

There’s no way to say for sure that this current environment will be the same as then or any other time in history but when we weigh the probabilities - this is why most advisors who have studied any amount of history/data will tell you - stay the course and stay invested.

I learned something else interesting about this period - but you’ll have to wait for tomorrow for that.

Aravind Sithamparapillai is an Investment Advisor with Aligned Capital Partners Inc. (“ACPI”). The opinions expressed are those of the author and not necessarily those of ACPI. This material is provided for general information and the opinions expressed and information provided herein are subject to change without notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on the information presented, please seek professional financial advice based on your personal circumstances. ACPI is a full-service investment dealer and a member of the Canadian Investor Protection Fund (“CIPF”) and the Canadian Investment Regulatory Organization (“CIRO”). Investment services are provided through ACPI or Ironwood Securities of Aligned Capital Partners Inc, an approved trade name of ACPI. Only investment-related products and services are offered through ACPI/ Ironwood Securities of Aligned Capital Partners Inc. and covered by the CIPF. Financial planning and insurance services are provided through Ironwood Wealth Management Group. Ironwood Wealth Management Group is an independent company separate and distinct from ACPI/ Ironwood Securities of Aligned Capital Partners Inc.