Midwives (and everyone else) - The value of your Notice of Assessment - Available RRSP Room

As taxes are filed and Notice of Assessments (NOA's) start to roll in - a quick recap on why we look at these, why we get CRA authorization, and some of the planning you can do with an NOA

For midwives and other self-employed higher earning professionals the Notice of Assessment (NOA) is a valuable tax document that comes just after tax filing and has quite a bit of handy information in there to help with general tax planning.

What is the Notice of Assessment?

The Notice of Assessment is a document that is produced once CRA has reviewed your full tax return and essentially said “ok - this is the summary of your net income, the taxes you paid, etc”. There are a few reasons the NOA can be useful - but for #midwifemonday I want to focus on one specific thing: the value of using it to understand the RRSP room for the year.

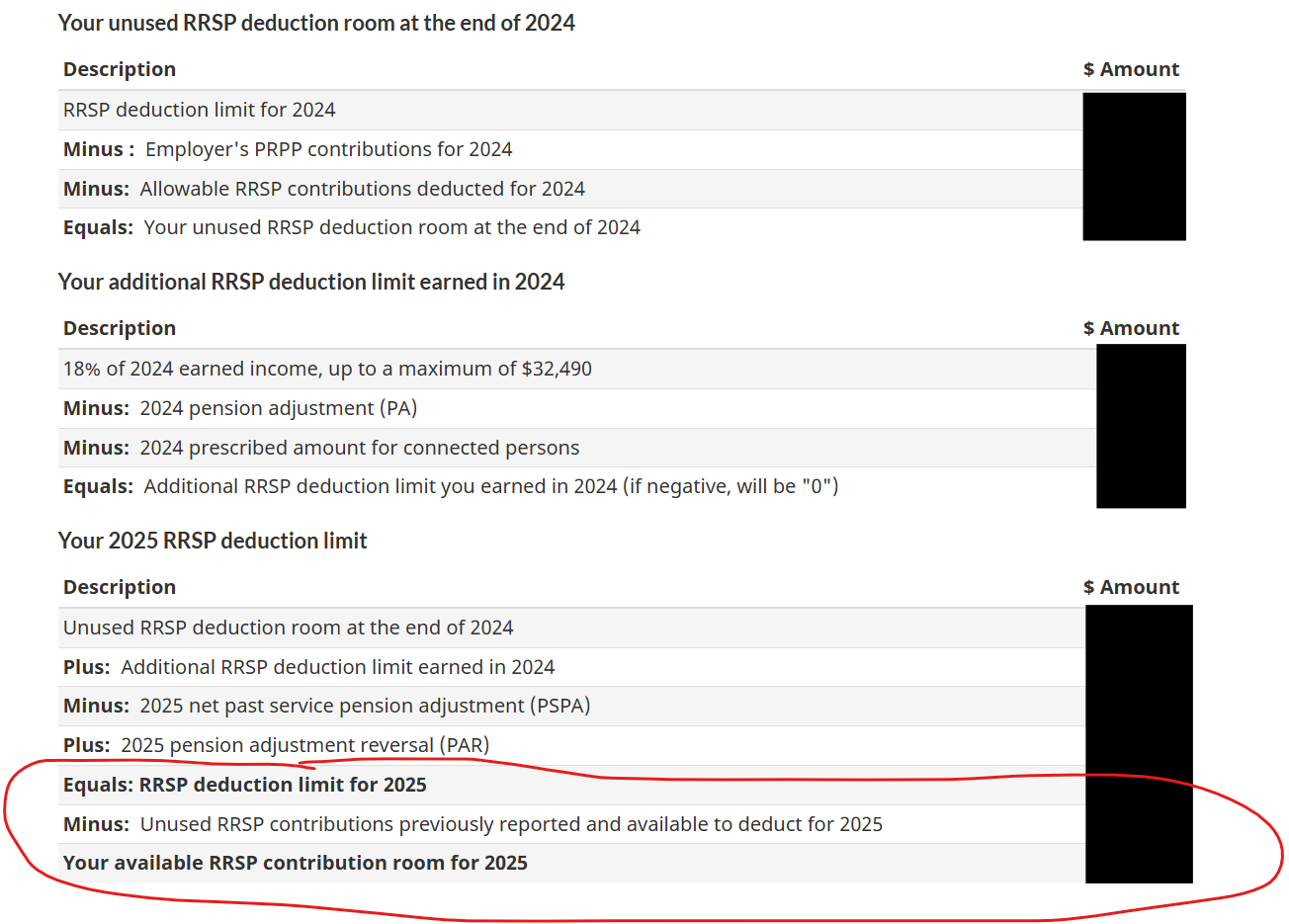

Here’s the RRSP Deduction Room portion of an NOA

Each piece tells you something important but I want to focus on the bottom that I’ve circled in red because that contains the information we need forward looking.

The first line - RRSP Deduction Limit for 2025 tells us how much in RRSP room we have if we started 2025. It essentially tallies up 2024 and gives us the “room available” after 2024 has been accounted for. It takes your 2024 contributions (or pension contributions) and reduces the RRSP room. It then adds new room based on your 2024 income.

Not all NOA’s will have the second line - The “unused RRSP contributions previously reported and available to deduct for 2025”. I chose to use this one to illustrate the concept of “ RRSP Contribution carry forwards”.

What are “Carry Forwards?”

Simply put - they are contributions that you made in prior years but didn’t choose to take the deduction on yet. These sit as a deduction that you get to choose to use at some point in the future should you so desire.

There are many planning cases around why someone would do this as maybe you want to put money into your RRSP for investment sheltering purposes but you know that next year you might be in a higher tax bracket (I used this planning trick with Ontario midwives a lot when they were receiving their lump sum pay outs from the government as an example and will write more about other cases in the future).

The other reason that carry forwards can happen is because of the first 60 day period of the year. Contributions to an RRSP in the first 60 days of the year can be chosen to either be used for the prior year OR…carried forward (see what I did there?).

In Ontario - a lot of midwives will get close to their RRSP limit and as such - end up with some contributions in the first 60 days that actually can’t be used for the prior year (because they used up all the room) and therefore it needs to be carried forward.

Ok - why does this matter?

This matters because the 3rd line - the “Available RRSP contribution room for 2025” is the REAL contribution that you have left. If you use the first line as your RRSP room - you are in danger of overcontributing.

The real complication is that Summary you get on your CRA dashboard when you log in? That shows you the first line. Not the true “net” contribution room remaining. (Thanks CRA - way to make it confusing).

Additionally - if you are a midwife in Ontario - The NOA and specifically the RRSP Deduction Room limit is what you need to avoid overcontributing to your group plan

Many midwives don’t know this - but you can actually take your notice of assessment with that available room limit - and provide it to the Association of Midwives Benefits Trust. This way - if you have a low amount of room - they have a flag for your account to make sure that the recurring group RRSP contributions don’t go over that amount. The remainder is then redirected into the leave savings account where you have some flexibility.

Aravind - this is just “one more thing” for me to do. I need to get an NOA, and look at it and understand it. If I’m a midwife (or really - anyone with a group RRSP) you are telling me I need to also monitor those contributions and figure out if I’m at risk of overcontributing? This feels like a lot.

I hear you. This is why we are building out processes for this. As CRA representatives - we can pull down your NOA. We can also request it from your accountant for review/commentary and it helps us determine things like how much to proactively put into your RRSP. It allows us to do better planning for all of you. For Ontario Midwives - we are also going one step further and documenting whether it has been sent to the AOMBT or working to send it on your behalf.

Why? Because that’s part of good planning. Knowing all the nuances means we’ve taken something off your plate that we are good at. It means one less thing for you AND it also reduces the risk of potentially having additional RRSP overcontribution penalties to deal with.

Aravind Sithamparapillai is an Investment Advisor with Aligned Capital Partners Inc. (“ACPI”). The opinions expressed are those of the author and not necessarily those of ACPI. This material is provided for general information and the opinions expressed and information provided herein are subject to change without notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on the information presented, please seek professional financial advice based on your personal circumstances. ACPI is a full-service investment dealer and a member of the Canadian Investor Protection Fund (“CIPF”) and the Canadian Investment Regulatory Organization (“CIRO”). Investment services are provided through ACPI or Ironwood Securities of Aligned Capital Partners Inc, an approved trade name of ACPI. Only investment-related products and services are offered through ACPI/ Ironwood Securities of Aligned Capital Partners Inc. and covered by the CIPF. Financial planning and insurance services are provided through Ironwood Wealth Management Group. Ironwood Wealth Management Group is an independent company separate and distinct from ACPI/ Ironwood Securities of Aligned Capital Partners Inc.